IMoneymy Learning Centre All Categories. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income.

Nigeria Individual Sample Personal Income Tax Calculation

Tax residents are subject to PIT on their worldwide employment income regardless of where the income is paid or earned at progressive rates from five percent to a maximum of 35 percent.

. The tax rate is concessional at 20 of the statutory income derived for businesses that are approved after the tax exempt period is expired up to a period of 10 years. Women who returned to work on or after 27 October 2017 can apply for income tax exemption if they were away from the workforce. Czech tax residents are generally subject to Czech income tax on their worldwide income.

Find out which income can be exempted from income tax in Malaysia for 2022. Buildings that are used with the sole purpose of approved business or expansion project as a BioNexus Company will get an industrial building allowance of 10 for a period of 10. All you need to know for filing your personal income tax in Malaysia by April 30 this year.

The amount deducted from the tax 17 minus the amount reducing PLN 5100. Tax non-residents are generally taxed only on income considered Czech-source income. For 2020 the PIT rate was 15 calculated from a so-called super-gross income which means that social and health insurance paid from salary by.

Personal income tax rates. As a result the tax-free amount is income up to PLN 30000 because if we calculate the tax at the rate of 17 from PLN 30000 this amount will be PLN 5100 ie. In the case of income up to PLN 120000 the tax is 17 minus the amount reducing the tax PLN 5100.

Ending Tax Avoidance Evasion And Money Laundering Through Private Trusts Acoss

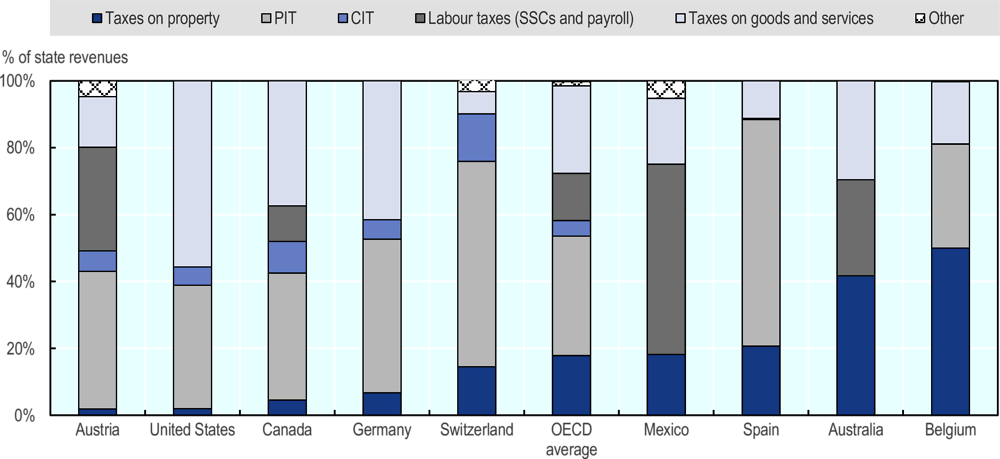

Population Ageing And Sub Central Governments Long Term Fiscal Challenges And Tax Policy Reform Options Ageing And Fiscal Challenges Across Levels Of Government Oecd Ilibrary

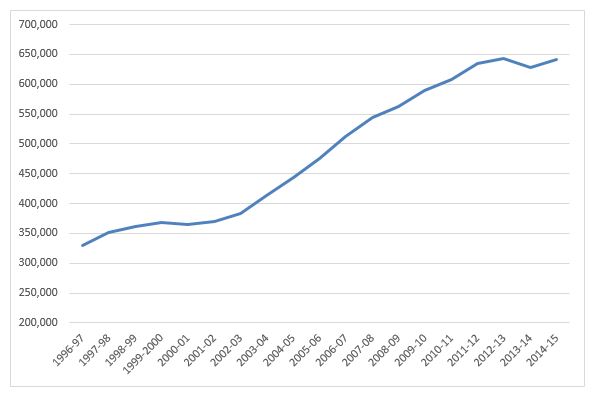

Epf Historical Returns Performance Mypf My

Malaysia Exports To Russia 2022 Data 2023 Forecast 2015 2021 Historical

3 21 3 Individual Income Tax Returns Internal Revenue Service

Trends In Production Trade And Consumption Of Tropical Fruit In Malaysia Fftc Agricultural Policy Platform Fftc Ap

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

Pakistan Gdp Growth Rate 2022 Data 2023 Forecast 1952 2021 Historical Chart

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Pressure To Raise Taxes Anticipated The Star

Individual Income Tax In Malaysia For Expatriates

Revenue Of Beauty Personal Care Malaysia 2025 Statista

Argentina Core Inflation Rate June 2022 Data 2017 2021 Historical July Forecast

Malaysia Maxis Bhd S Total Revenue 2021 Statista